Introduction

Carbon credits are a critical tool in the global effort to combat climate change, allowing businesses and individuals to offset their carbon emissions by investing in environmental projects around the world. However, the effectiveness and credibility of these credits hinge on a rigorous certification process. This certification ensures that each credit represents a genuine, quantifiable reduction in carbon emissions. As the market for carbon credits grows, driven by increasing corporate responsibility and regulatory frameworks, understanding who certifies these credits and how this process is upheld is essential. This article delves into the world of carbon credit certification, exploring the key players, processes, and standards that ensure these environmental investments truly contribute to mitigating climate impacts.

Understanding Carbon Credits

Carbon credits are financial instruments that represent the removal of one ton of carbon dioxide or an equivalent amount of other greenhouse gases from the atmosphere. These credits are generated through various environmental projects, such as renewable energy installations, reforestation efforts, and improvements in energy efficiency. By purchasing carbon credits, businesses and individuals can offset their own emissions, contributing indirectly to the reduction of global greenhouse gases. Learn more about carbon credit history here.

The carbon credit market is divided into two main segments: voluntary markets and compliance markets. Understanding the distinctions between these markets is crucial for grasping how carbon credits function and are regulated.

Voluntary Carbon Markets

Voluntary carbon markets allow companies, governments, and individuals to purchase carbon credits on a voluntary basis. The primary motivation here is to achieve carbon neutrality or meet corporate social responsibility goals rather than to comply with legal obligations. Participants in this market can choose from a broader range of projects and have greater flexibility in terms of the types of credits they buy. This market is characterized by its innovation and diversity of projects, including those that may not qualify under stricter compliance schemes but still provide environmental benefits.

Compliance Carbon Markets

In contrast, compliance carbon markets are regulatory systems set by national, regional, or international bodies that require entities to emit no more than a certain amount of greenhouse gases. If they exceed these caps, they must purchase carbon credits to offset their excess emissions. This market is typically stricter, with credits often coming from projects that have undergone more rigorous verification processes. Examples include the European Union’s Emissions Trading Scheme (EU ETS) and the California Cap-and-Trade Program. The goal of these markets is to drive industrial players towards lower emissions through a cap-and-trade system.

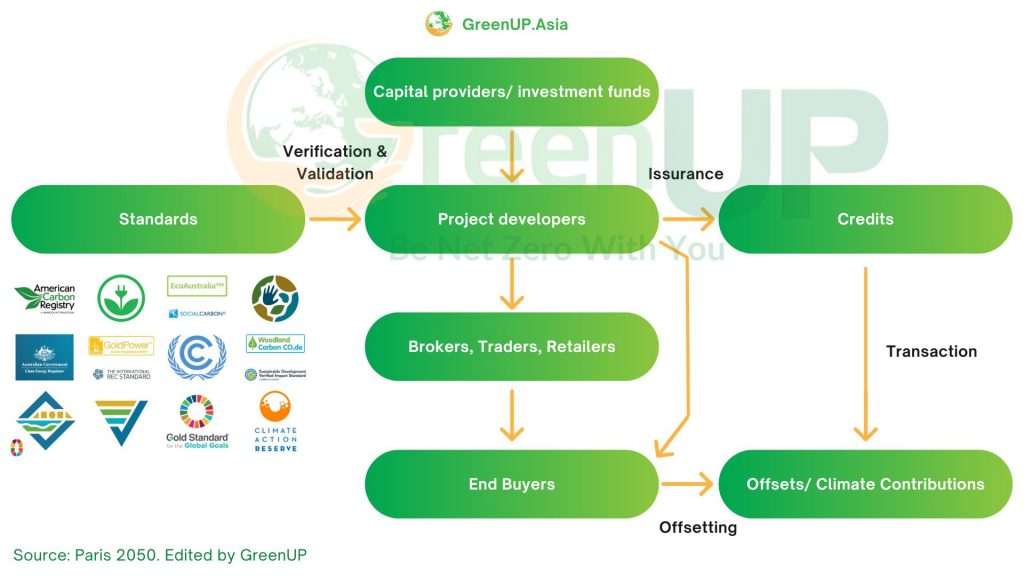

Key Organizations Involved in Certification

The certification of carbon credits involves several reputable organizations, each playing a crucial role in ensuring the integrity and effectiveness of the credits issued. These organizations set standards, verify projects, and ensure compliance with international and local regulations. Below, we delve into some of the primary certifying bodies and their methodologies.

United Nations Framework Convention on Climate Change (UNFCCC)

UNFCCC stands at the forefront of international environmental diplomacy, with its primary focus being to stabilize greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system. Established in 1992 during the Earth Summit in Rio de Janeiro, the UNFCCC is a treaty that has near-universal membership, encompassing 197 countries.

One of the key mechanisms under the UNFCCC is the Clean Development Mechanism (CDM), which was defined in the Kyoto Protocol, an international treaty that extends the 1992 UNFCCC convention. The CDM allows emission-reduction projects in developing countries to earn certified emission reduction (CER) credits, each of which is equivalent to one tonne of CO2. These projects can range from renewable energy projects to forest regeneration efforts.

Each CER can be traded, sold, or used by industrialized countries to meet a part of their emission reduction targets under the Kyoto Protocol. This creates a financial incentive for companies to invest in emission-reduction technologies. The trading of CERs has given rise to a new financial market, which operates both within the countries bound by the Kyoto Protocol and on the global stage through voluntary markets.

Verified Carbon Standard (VCS)

The Verified Carbon Standard, also known as Verra, is a leading standard for certifying carbon credits in the voluntary carbon market. Established in 2005 by Verra, a nonprofit organization, VCS aims to provide a credible and robust framework for measuring carbon emissions and reducing them through various projects around the world. This standard helps ensure that the carbon credits generated are both real and verifiable.

The VCS operates by setting out criteria that projects must meet to generate Verified Carbon Units (VCUs). Each VCU represents a reduction or removal of one tonne of CO2 or its equivalent in other greenhouse gases. Projects that can apply for VCS certification range widely, including renewable energy, forestry, agricultural, and methane capture initiatives.

Gold Standard

The Gold Standard was established in 2003 by WWF and other international NGOs to ensure carbon offset projects meet the highest standards of environmental integrity and contribute to sustainable development. This certification framework was designed to build trust in carbon markets by providing a rigorous, transparent method to quantify, certify, and monitor the impact of carbon reduction projects. It ensures that these projects actually reduce CO2 emissions and provide additional societal benefits, such as improving local environmental quality and community health. The Gold Standard has evolved to include broader sustainability projects beyond carbon emissions, emphasizing holistic environmental and social impacts.

American Carbon Registry (ACR)

The American Carbon Registry, established in 1996, is a leading carbon offset program in the United States, known for its rigorous standards for quantifying, verifying, and reporting carbon emissions reductions. ACR operates under the nonprofit organization Winrock International and supports voluntary emission reduction projects across various sectors including forestry, renewable energy, and methane capture. The registry provides a platform for issuing and trading carbon credits, ensuring transparency and integrity in the environmental markets to address climate change.

Climate Action Reserve (CAR)

The Climate Action Reserve is a prominent carbon offset registry in North America, established to ensure environmental integrity, transparency, and financial value in the carbon market. CAR develops and manages high-quality, voluntary greenhouse gas (GHG) reduction programs. It sets consistent and transparent standards that both quantify and verify carbon reduction projects across various sectors, enhancing the environmental impact of carbon offset credits. CAR plays a crucial role in motivating individuals, companies, and governments towards sustainable practices and carbon neutrality.

Each of these organizations employs specific methodologies tailored to different types of carbon offset projects. Methodologies define how projects should quantify emissions reductions and what monitoring protocols should be followed. After a project developer selects an appropriate methodology and implements the project, it must undergo a validation process by a third-party verifier accredited by the certification standard. This step ensures that the project design is scientifically sound and capable of achieving the proposed emissions reductions. Post-validation, projects enter the verification phase, where verifiers again assess whether the project has achieved its emissions reductions according to the methodology. Successful verification leads to the issuance of carbon credits, which can then be sold or traded.

Standards and Criteria for Certification

The certification of carbon credits relies on various standards that set forth the criteria projects must meet to ensure their environmental integrity and effectiveness. These standards are crucial in maintaining the trust and credibility of carbon markets. Here we discuss some common standards used in certifying carbon credits, the key criteria for certification, and how these standards uphold the quality and impact of carbon credits.

Common Standards Used in Certifying Carbon Credits:

- Verified Carbon Standard (VCS): The VCS, managed by Verra, is one of the most widely utilized standards in both voluntary and compliance markets. It provides a framework for verifying and issuing carbon credits in sectors like forestry, renewable energy, and methane capture.

- Gold Standard: The Gold Standard, which focuses heavily on sustainable development, is often used for projects that also seek to deliver social, economic, and environmental benefits alongside reducing emissions. This standard is favored by organizations that aim to meet Corporate Social Responsibility (CSR) objectives.

- Clean Development Mechanism (CDM): Under the UNFCCC, the CDM allows emission-reduction projects in developing countries to earn certified emission reduction credits. This mechanism is critical in the compliance market, particularly under the Kyoto Protocol.

- American Carbon Registry (ACR): The ACR develops methodology standards for certifying emission reductions from various projects, providing a rigorous framework for emission reduction quantification.

- Climate Action Reserve (CAR): CAR focuses on North American markets and provides standards that ensure the real, permanent, and verifiable reductions of greenhouse gas emissions.

The criteria for the certification of carbon credits are essential to ensure the effectiveness and credibility of carbon offset projects. These criteria address various aspects of the projects, from the quantification of emissions reductions to their long-term impact. Here, we delve deeper into each of these key criteria:

- Additionality: It requires projects to demonstrate that the carbon reductions achieved would not have occurred without the financial incentives provided by the carbon market. This involves a detailed assessment of the project’s baseline scenario — what the state of emissions would have been in the absence of the project. The project must prove that its activities are not standard practice in the industry or region and go beyond any existing legal requirements.

- Permanence: Permanence refers to the duration that the reduced or sequestered carbon remains out of the atmosphere, aiming to ensure that benefits are long-lasting. Projects involving forestry, for example, must address risks like deforestation, natural disasters, or changes in land use that could release sequestered carbon back into the atmosphere. Mechanisms such as buffer pools (reserves of credits set aside to compensate for any future loss of carbon) are often employed to manage these risks.

- Verifiability: Verifiability ensures that the emission reductions can be accurately measured and are open to independent auditing. This requires projects to use clear, transparent, and robust monitoring methodologies. Data must be accessible so that third-party auditors can verify the reported reductions. This process is vital to maintain the trust of investors, buyers, and regulatory bodies in the authenticity of the credits.

- Leakage: Leakage is the unintended consequence where reducing emissions in one area leads to an increase elsewhere. For instance, protecting a forest in one area might push deforestation activities to another area if the overall demand for timber remains unchanged. Projects must evaluate and mitigate any potential leakage effects to ensure that their net impact results in a real decrease in global emissions.

- Transparency: Transparency involves making all relevant information about the project publicly available. This includes the project design document (PDD), methodologies used, results of environmental and social impact assessments, and details of ongoing monitoring and verification activities. Transparency builds trust among stakeholders and the public by allowing scrutiny and ensuring that projects are held accountable for their environmental claims.

- Consistency: Consistency applies to the application of methodologies throughout the project’s duration. Projects must consistently apply approved methodologies to monitor and report GHG reductions. This ensures that the project remains in compliance with the certifying standard over time and that the emissions reductions are continuously achieved as claimed.

- Social and Environmental Benefits: While not always a formal requirement, many standards, particularly those like the Gold Standard, require projects to demonstrate positive social and environmental impacts beyond just reducing emissions. This includes contributing to local community development, biodiversity conservation, and alignment with broader sustainability goals. Projects that demonstrate these additional benefits often receive higher credibility and can attract more investment in the carbon market.

Each of these criteria plays a critical role in the certification process, ensuring that carbon credits are not only a tool for offsetting emissions but also contribute positively to environmental sustainability and social development. By meeting these rigorous criteria, projects can provide verifiable, additional, and permanent benefits that help mitigate climate change effectively.

The Certification Process

The certification of carbon credits is a meticulous process designed to ensure that each credit represents a real, measurable, and permanent reduction or sequestration of carbon dioxide emissions. This section explains the meaning of certification in the context of carbon credits and describes the step-by-step process involved.

Certification in the context of carbon credits is the formal recognition that specific emissions reductions or carbon sequestration activities meet established standards and criteria. This certification process is crucial as it verifies that the projects contributing to these reductions are both effective and reliable, thus ensuring the integrity of the carbon credits they generate.

Step-by-Step Process of Carbon Credit Certification

Project Development and Proposal:

1. Idea Conception and Feasibility Study: The process begins with the project developer identifying a potential project, conducting feasibility studies, and assessing its potential for reducing or sequestering GHG emissions.

2. Baseline Scenario: The developer establishes a baseline scenario, which predicts the amount of emissions that would occur in the absence of the proposed project.

3. Additionality and Project Design: The project must demonstrate additionality, showing that the emissions reductions would not have occurred without the project. The project’s design is then detailed in a Project Design Document (PDD), which includes the project’s scope, intended methodologies, expected impact, and mechanisms to address risks like leakage and non-permanence.

Validation by Third-Party Bodies:

4. Selection of a Standard: The developer chooses a certification standard (such as VCS, Gold Standard, or CDM) suitable for the project type and market.

5. Third-Party Validation: An independent validator, accredited by the chosen standard, reviews the PDD to ensure the project’s planned activities and expected reductions are credible and feasible. The validator assesses the project’s compliance with the chosen standard’s requirements, focusing on additionality, baseline integrity, and the environmental and social impacts.

Monitoring and Verification:

6. Implementation and Monitoring: Once validated, the project is implemented. Throughout the project’s operation, continuous monitoring is conducted according to the methodologies outlined in the PDD.

7. Verification: At designated intervals, an independent verifier reviews the project to confirm that the emissions reductions have indeed been achieved as projected. This verification is critical for the project to be issued carbon credits.

Issuance of Credits:

8. Credit Issuance: After successful verification, the certifying body issues carbon credits, each representing one tonne of CO2 equivalent reduced or sequestered by the project. These credits can then be sold on carbon markets.

Role of Ongoing Monitoring and Issuance of Credits:

- Ongoing Monitoring: Continuous monitoring is essential to ensure that the project adheres to its design and continues to achieve the projected emissions reductions over its lifespan.

- Repeat Verification and Issuance: Projects typically undergo verification annually or biennially to continue generating credits. This ongoing cycle of monitoring and verification ensures that the project maintains its integrity and continues to contribute to emissions reductions.

The robustness of this certification process is vital in maintaining stakeholder confidence in the carbon markets. It ensures that investors, regulators, and the public can trust that the carbon credits are not only a viable but also a verifiable solution to climate change mitigation.

Challenges and Criticisms in Certification

The certification of carbon credits, while vital for ensuring the integrity of climate mitigation efforts, faces several challenges and criticisms that can impact its effectiveness and public trust.

Common Challenges in the Certification Process

- Complexity: The process of certifying carbon credits can be incredibly complex, involving detailed project planning, rigorous standards, and multiple phases of verification. This complexity can be a barrier for smaller projects or those in developing countries where technical expertise and resources may be limited.

- Costs: The financial burden associated with the certification process can be substantial. Expenses include the costs of preparing detailed project documents, conducting feasibility studies, and paying for third-party validation and verification. These costs can deter smaller or community-based projects from participating in carbon markets.

- Potential for Fraud: There is always a risk of fraudulent activities in carbon markets, such as overestimating carbon savings, falsifying data, or failing to maintain project standards over time. These risks necessitate stringent verification processes, but even these are not foolproof.

Criticisms Regarding the Effectiveness and Transparency of the Certification Process

- Effectiveness: Critics often question whether carbon credits actually contribute to reducing global carbon emissions. Concerns include issues like leakage, where emissions are reduced in one area but increase in another, and the permanence of carbon sequestration, particularly in forestry projects.

- Transparency: While transparency is a fundamental criterion for certification, there are still concerns about how open and accessible project information is to the public. This can lead to skepticism about the true environmental and social impacts of carbon offset projects.

Several high-profile cases have highlighted the potential pitfalls of carbon credit certification:

- The CDM Hydro Project in Panama: Local communities protested against a hydroelectric project certified under the CDM, claiming it led to environmental damage and displacement without providing the promised local benefits.

- Reforestation Projects in Brazil: Some projects intended to generate carbon credits through reforestation have been criticized for not actually planting as many trees as claimed, or for displacing local farmers.

The Future of Carbon Credit Certification

As the global community continues to combat climate change, the certification of carbon credits is evolving with new trends and technologies that could enhance its effectiveness and reliability. Emerging Trends and Technologies Affecting Certification:

- Blockchain Technology: Blockchain offers a promising solution to enhance transparency and reduce fraud in carbon markets. By using decentralized ledgers to record transactions, blockchain can provide a tamper-proof and publicly accessible record of carbon credit generation and trading.

- Artificial Intelligence and Remote Sensing: AI and remote sensing technologies can improve the monitoring and verification processes by providing more accurate and real-time data on project impacts. These technologies can help detect anomalies that may indicate non-compliance or fraud.

- Potential Changes in Regulations and Their Impact on Certification: Regulatory changes, particularly at the international level, could streamline the certification process and enforce stricter standards to improve the credibility of carbon credits. For instance, the implementation of Article 6 of the Paris Agreement could lead to more standardized global rules for carbon markets.

- The Role of Certification in Achieving Global Climate Goals: The certification of carbon credits plays a critical role in global climate policy by enabling the operationalization of market-based mechanisms to reduce emissions. Effective certification is crucial for ensuring that these mechanisms contribute genuinely to achieving the targets set under the Paris Agreement and other international commitments.

Conclusion

By ensuring that each credit represents a tangible, quantifiable reduction in greenhouse gases, certification processes uphold the integrity and efficacy of carbon markets. These markets, in turn, provide essential financial incentives for carbon reduction projects, from renewable energy initiatives to forest conservation efforts.

However, the certification process is not without its challenges. It must continuously evolve to address complexities, reduce costs, and mitigate fraud risks to remain effective. Transparency, rigor, and accountability are crucial to maintaining stakeholder trust and public confidence in the system. Criticisms regarding the real impact of carbon credits on emission reductions and their sometimes opaque nature call for ongoing reforms and enhancements in certification practices.

Emerging technologies such as blockchain and advanced remote sensing offer promising avenues to improve these processes. Blockchain, for instance, can enhance transparency and traceability, potentially revolutionizing how carbon credit transactions are recorded and verified. Similarly, AI and satellite technology can provide more accurate and timely data for monitoring project outcomes, ensuring that credits are awarded based on real and verifiable environmental benefits.

Furthermore, as international climate agreements evolve, regulatory changes are likely to refine and standardize carbon credit markets further. These changes are crucial for ensuring that the certification mechanisms align with broader environmental goals and contribute effectively to global climate commitments, such as those outlined in the Paris Agreement.

Ultimately, the role of certification in carbon markets is indispensable. It ensures that they contribute meaningfully to the overarching goal of global climate mitigation. As we move forward, the continuous improvement of certification standards and processes will be paramount in leveraging carbon markets to their fullest potential, helping to forge a sustainable and low-carbon future.

References

- 8 Billion Trees. (n.d.). ‘Carbon Credit Pricing’. [online] Available at: https://8billiontrees.com/carbon-offsets-credits/new-buyers-market-guide/carbon-credit-pricing/.

- Cambridge Digital Innovation. (n.d.). ‘Technology and the Voluntary Carbon Markets’. [online] Available at: https://www.cambridgedigitalinnovation.org/single-post/technology-and-the-voluntary-carbon-markets.

- CarbonBetter. (n.d.). ‘Carbon Offset Registries’. [online] Available at: https://carbonbetter.com/story/carbon-offset-registries/.

- Carbon Credit Capital. (n.d.). ‘Who Issues Carbon Credits & How?’. [online] Available at: https://carboncreditcapital.com/who-issues-carbon-credits-how/.

- Carbon Credits. (n.d.). ‘Nasdaq reveals revolutionary tech for carbon credits to propel carbon markets’. [online] Available at: https://carboncredits.com/nasdaq-reveals-revolutionary-tech-for-carbon-credits-to-propel-carbon-markets/.

- Carbon Credits. (n.d.). ‘The Ultimate Guide to Understanding Carbon Credits’. [online] Available at: https://carboncredits.com/the-ultimate-guide-to-understanding-carbon-credits/.

- Change Climate. (n.d.). ‘Explore’. [online] Available at: https://explore.changeclimate.org.

- Change Climate. (n.d.). ‘How It Works’. [online] Available at: https://www.changeclimate.org/how-it-works.

- Chooose. (n.d.). ‘Carbon Credit Explained: An Introduction to Carbon Markets’. [online] Available at: https://www.chooose.today/insights/carbon-credit-explained-an-introduction-to-carbon-markets.

- Corporate Finance Institute. (n.d.). ‘Carbon Markets’. [online] Available at: https://corporatefinanceinstitute.com/resources/esg/carbon-markets/.

- Ecocart. (n.d.). ‘How Carbon Credits Are Verified’. [online] Available at: https://ecocart.io/how-carbon-credits-are-verified/.

- EO4SDG. (n.d.). ‘Emerging Technologies Reshaping the Carbon Offset Industry Credibility’. [online] Available at: https://eo4sdg.org/emerging-technologies-reshaping-carbon-offset-industry-credibility/.

- European Parliament. (2022). ‘EPRS BRI(2022)739222 EN’. [pdf] Available at: https://www.europarl.europa.eu/RegData/etudes/BRIE/2022/739222/EPRS_BRI%282022%29739222_EN.pdf.

- FG Capital Advisors. (n.d.). ‘Carbon Credit Certification Process’. [online] Available at: https://www.fgcapitaladvisors.com/carbon-credit-certification-process.

- IMD. (n.d.). ‘How Blockchain Can Clean Up the Voluntary Carbon Market’. [online] Available at: https://www.imd.org/ibyimd/technology/how-blockchain-can-clean-up-the-voluntary-carbon-market/.

- Investopedia. (n.d.). ‘Carbon Markets’. [online] Available at: https://www.investopedia.com/carbon-markets-7972128.

- Le Monde. (2023). ‘Three carbon offset projects in Brazil accused of being scams’. [online] Available at: https://www.lemonde.fr/en/economy/article/2023/11/20/three-carbon-offset-projects-in-brazil-accused-of-being-scams_6271470_19.html.

- LinkedIn. (n.d.). ‘Carbon Credit Certification: Understanding Standards & Verification’. [online] Available at: https://www.linkedin.com/pulse/carbon-credit-certification-understanding-standards-verification-9z9hf.

- Offset Guide. (n.d.). ‘Understanding Carbon Offset Programs’. [online] Available at: https://www.offsetguide.org/understanding-carbon-offsets/carbon-offset-programs/.

- Riverse. (n.d.). ‘How much does it cost to issue carbon credits?’. [online] Available at: https://www.riverse.io/faq/how-much-it-cost-to-issue-carbon-credits.

- Senken. (n.d.). ‘Pricing of Carbon Credits’. [online] Available at: https://www.senken.io/academy/pricing-of-carbon-credits.

- UNDP Climate Promise. (n.d.). ‘What are Carbon Markets and Why Are They Important’. [online] Available at: https://climatepromise.undp.org/news-and-stories/what-are-carbon-markets-and-why-are-they-important.

- UNFCCC. (2007). ‘The Carbon Market’. [online] Available at: https://unfccc.int/process/conferences/pastconferences/bali-climate-change-conference-december-2007/statements-and-resources/the-carbon-market.

- USAID. (2022). ‘LEAP III – Carbon Markets Brief’. [pdf] Available at: https://www.climatelinks.org/sites/default/files/asset/document/2022-04/LEAP%20III%20-%20Carbon%20Markets%20Brief_final%20%28508%20Compliant%29.pdf.

- Verra. (n.d.). ‘Verified Carbon Standard’. [online] Available at: https://verra.org/programs/verified-carbon-standard/.

- World Bank. (2023). ‘COP28 World Bank Engagement Roadmap for Carbon Markets’. [pdf] Available at: https://thedocs.worldbank.org/en/doc/12facd8b391a1eafa5dd53e7ddc5eeb5-0020012023/original/COP28-World-Bank-Engagement-Roadmap-for-Carbon-Markets.pdf.