Introduction Social Factor in ESG

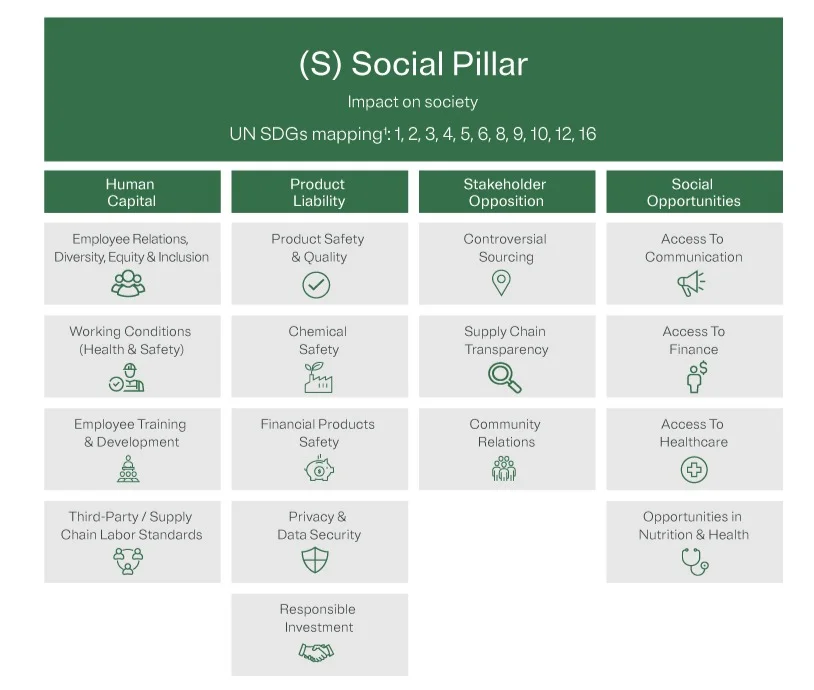

The “S” factor in ESG has gained significant attention, particularly in the context of recent global events such as the COVID-19 pandemic and social movements. This factor encompasses how a company interacts with its employees, suppliers, customers, and the communities where it operates. Key aspects include health and safety, human rights, labor rights, equality, and diversity, equity, and inclusion (DEI).

Measuring the “S” Factor in ESG

Measuring the “S” factor in ESG investing involves evaluating various social metrics that reflect a company’s relationship with its employees, customers, suppliers, and the broader community. Here are some key metrics often used in assessing the social aspect of a company’s performance:

Employee Engagement and Satisfaction: This metric assesses how well a company treats its employees, which can include factors such as job satisfaction, engagement levels, turnover rates, training opportunities, and work-life balance. High employee engagement typically correlates with better productivity and lower turnover.

Diversity and Inclusion: This involves measuring the diversity of a company’s workforce and leadership, including gender, race, and cultural background. It also assesses the inclusiveness of a company’s policies and practices, such as equal opportunity, anti-discrimination policies, and initiatives that promote a diverse and inclusive workplace.

Labor Standards: This metric evaluates a company’s adherence to fair labor practices. It includes compliance with minimum wage laws, ensuring safe working conditions, respecting workers’ rights to collective bargaining, and avoiding child or forced labor in both their operations and supply chain.

Health and Safety: This metric assesses a company’s health and safety standards, particularly in industries where physical labor is involved. It includes the frequency of workplace accidents, the severity of incidents, and the effectiveness of health and safety policies.

Supply Chain Management: This metric evaluates how a company manages its supply chain, particularly in terms of social impact. It includes assessing whether suppliers adhere to ethical practices, such as fair labor standards and human rights considerations.

Community Engagement: This involves evaluating a company’s impact on the communities in which it operates. It includes charitable contributions, community development programs, and engagement in local issues.

Product Responsibility: This metric looks at the safety, quality, and integrity of the products or services a company offers, including issues related to consumer health and safety, labeling, and marketing practices.

Human Rights Practices: This includes assessing a company’s commitment to protecting human rights within its operations and supply chain. It involves evaluating the company’s policies and practices related to human rights issues, such as preventing exploitation and abuse.

Issues with the “S” Factor in ESG

The “S” factor in ESG investing, which focuses on social aspects, faces several key issues, especially concerning data and measurement. The challenges in this domain arise mainly from the nature of social impacts and the methodologies used to assess them.

Materiality Focus by Rating Agencies:

- Agencies like Moody’s and S&P primarily view ESG through the lens of financial performance impact.

- This approach is more suited for credit risk evaluation than capturing the full scope of social impact for equity investors.

- Positive social impacts that could lead to competitive advantages are often underrepresented in ESG data.

Lack of Standardization in Social Impact Measurement:

- Absence of a reliable, quantitative measurement standard for social impacts.

- Inconsistencies in how different organizations define, measure, and report social impacts.

- Existing frameworks like the UNSDGs are not universally applicable to all companies and lack specific, measurable business targets.

Challenges in Quantifying Social Impacts:

- Need for standard thresholds to quantify impacts on issues like hunger, education, and employment.

- Social impacts are not as easily quantifiable as environmental impacts, like greenhouse gas emissions.

Reporting Focus on Material Risks Over Benefits:

- Traditional ESG reporting emphasizes disclosure of material risks rather than material benefits.

- The concept of materiality in ESG should include both negative and positive aspects affecting corporate performance.

Increasing Importance of Social Factors in Business Decision-Making:

- Growing emphasis on corporate social responsibility.

- Rising influence of the millennial generation and impact investing movement.

- Need for transparency and due diligence to meet investor demands.

Challenges in Incorporating Social Considerations into Business Decisions:

- Ensuring fair and respectful treatment of employees, customers, suppliers, and other stakeholders.

- Addressing past harms and implementing protective policies.

- Balancing various social obligations while maintaining business objectives.

Benefits of the “S” Factor in ESG

Improved Human Capital Management: Companies focusing on their employees’ health and well-being tend to retain and develop top talent more effectively. This includes providing better work environments and healthcare benefits, which can lead to improved overall company performance.

Enhanced Diversity, Equity, and Inclusion: A commitment to diversity, equity, and inclusion can create shareholder value over the long term. Research suggests that having more women in senior leadership positions, for example, can positively impact a company’s financial returns.

Risk Management Along the Supply Chain: Addressing social issues in the supply chain, such as worker treatment and environmental damage, can help companies avoid penalties, fines, or litigation. This improves their operational stability and reputation.

Leveraging Big Data for Social Insights: The advancement in big data and AI technologies allows for more detailed analysis of social factors. This includes assessing workforce diversity beyond quotas, analyzing employee reviews for company culture insights, and identifying sector-specific issues like health and safety in mining.

Driving Positive Social Change Through Investment: Investors can influence companies to bring about positive social change. Engaging with companies on issues like poor working conditions or lack of diversity can lead to sustainable outcomes, improving both societal impact and financial performance.

Effective Response to Evolving Social Dynamics: Companies that effectively manage social factors are better equipped to respond to changing societal expectations and demands, enhancing their long-term viability and competitiveness.

Conclusion

The importance of the “S” factor in ESG is expected to continue growing. Its integration into business decisions ensures fair and respectful treatment of all stakeholders, which is increasingly demanded by investors. Companies that neglect this aspect may find themselves at a competitive disadvantage, emphasizing the critical role of social responsibility in contemporary business practices.

About GreenUP

Pioneering the Green Transition with Expertise and Innovation. With over 10 million I-RECs issued since 2019, we are Vietnam’s leaders in renewable energy certification. Our comprehensive suite of services, positions us uniquely as a one-stop solution for all your green and ESG needs. Experience unparalleled market access, competitive pricing, and strategic partnerships that drive not only cost savings but also significant value to your sustainability goals.

References

- Horton, C. (2022) ‘Explainer: What is the ‘S’ in ESG investing?’, Reuters. Available at: https://www.reuters.com/business/sustainable-business/what-is-s-esg-investing-2022-07-19/.

- Diolosa, J. (2021) ‘Spotlight on the ‘S’ of ESG: The rise of social factors’, Sharesight Blog. Available at: https://www.sharesight.com/blog/spotlight-on-the-s-of-esg-the-rise-of-social-factors/.

- Carbon Collective (no date) ‘Social factors (S in ESG) | Definition, Areas of Interests, & Impacts’, Carbon Collective. Available at: https://www.carboncollective.co/climate-investing-101/social-factors-s-in-esg.

- SSIR.org (2019) ‘The S in ESG Investing Has a Data and Measurement Problem’, SSIR.org. Available at: https://ssir.org/articles/entry/the_s_in_esg_investing_has_a_data_and_measurement_problem.

- S&P Global (2020) ‘What is the “S” in ESG?’, S&P Global. Available at: https://www.spglobal.com/en/.

- Sheen, M. (2020) ‘The ‘S’ in ESG: What benefits can social factor analysis offer investors?’, Investment Week. Available at: https://www.investmentweek.co.uk/analysis/4011932/esg-benefits-social-factor-analysis-offer-investors.

- J.P. Morgan Asset Management (no date) ‘ESG Social Factors: Accessing the “S” in ESG’, J.P. Morgan Asset Management. Available at: https://am.jpmorgan.com/global/research/esg-social-factors.