History Overview

Early Developments

- 2004: The term “ESG” gained popularity with the “Who Cares Wins” report, published at the invitation of the United Nations (U.N.), involving a group of banks and investment firms. This report emphasized the integration of ESG issues in investment analysis and decision-making.

- 2005: The Freshfields report, backed by the U.N., suggested that financial trustees should consider environmental and social factors in their analysis of companies, paving the way for investing for sustainability impact (IFSI).

- 2006: The Principles for Responsible Investment were established by a group of investment and environmental experts, advocating for the inclusion of ESG considerations in investment decisions.

Expansion and Focus on Climate

- 2007: The Climate Disclosure Standards Board (CDSB) was formed, creating a reporting framework that highlighted the risks and opportunities of climate change on an organization’s strategies and financial performance.

- 2010: The SEC issued its Commission Guidance Regarding Disclosure Related to Climate Change, marking a significant step in addressing climate risk in financial disclosures.

Standardization and Framework Development

- 2011: The Sustainability Accounting Standards Board was launched to develop meaningful accounting standards reflecting the impact of ESG factors specific to industries.

- 2015: The U.N. General Assembly formulated the Sustainable Development Goals (SDGs), later detailed with specific targets and indicators covering a broad range of issues from poverty to sustainability.

- 2015: The Taskforce on Climate-related Financial Disclosures (TCFD) was launched by the Financial Stability Board to work on standards for reporting climate-related disclosures for various entities.

Recent Years and Increasing Regulation

- 2016-2019: Various initiatives like the Workforce Disclosure Initiative, The Compact for Responsive and Responsible Leadership, and the Davos Manifesto 2020 emphasized the importance of diverse ESG initiatives and ethical principles for companies.

- 2020 onwards: The COVID-19 pandemic, along with other global events, underscored the need for robust ESG practices and disclosures. This period saw an increasing focus on regulatory requirements for ESG disclosures across different jurisdictions, including the establishment of the International Sustainability Standards Board (ISSB) and growing emphasis on mandatory ESG-related disclosures.

- 2022 and beyond: There has been a significant shift in the ESG reporting landscape, with regulatory bodies across multiple jurisdictions actively engaging in consultations and developing frameworks for climate risk, human capital, and diversity disclosure considerations. The SEC, for instance, indicated its intention to publish proposed rules for climate risk and human capital management disclosure.

The regulatory landscape for ESG presents a complex and dynamic environment across different continents. As businesses and financial institutions navigate this terrain, understanding the diverse and evolving regulations in each region is crucial.

ESG in Europe

The ESG regulatory landscape in Europe has evolved considerably, with a range of initiatives and regulations introduced to enhance transparency, accountability, and sustainability in business operations.

- France and Germany: Both France and Germany have made significant strides in ESG regulation. France’s “Duty of Vigilance” law, effective in 2017, requires companies to conduct human rights and environmental due diligence. Similarly, Germany’s “Corporate Due Diligence in Supply Chains Act” came into force in January 2023, focusing on corporate accountability for supply chain practices.

- United Kingdom: In the UK, significant developments in ESG regulations include the phased-in application of the Sustainability Disclosure Requirements (SDR). These requirements aim to improve trust and transparency in sustainable investment products by establishing common standards, terminology, and accessible product classification and labels. They also include anti-greenwashing rules that will be enforced from May 31, 2024. Additionally, the UK is developing its Sustainability Disclosure Standards (SDS) for baseline reporting on sustainability and climate-related risks, expected to be finalized by the end of 2024 and come into effect in 2025.

- Switzerland: Switzerland is known for its preference for a self-regulatory approach. However, 2024 will see new reporting expectations for some companies under its Code of Obligations, including non-financial reporting on environmental issues, CO2 targets, social issues, human rights, and anti-corruption measures.

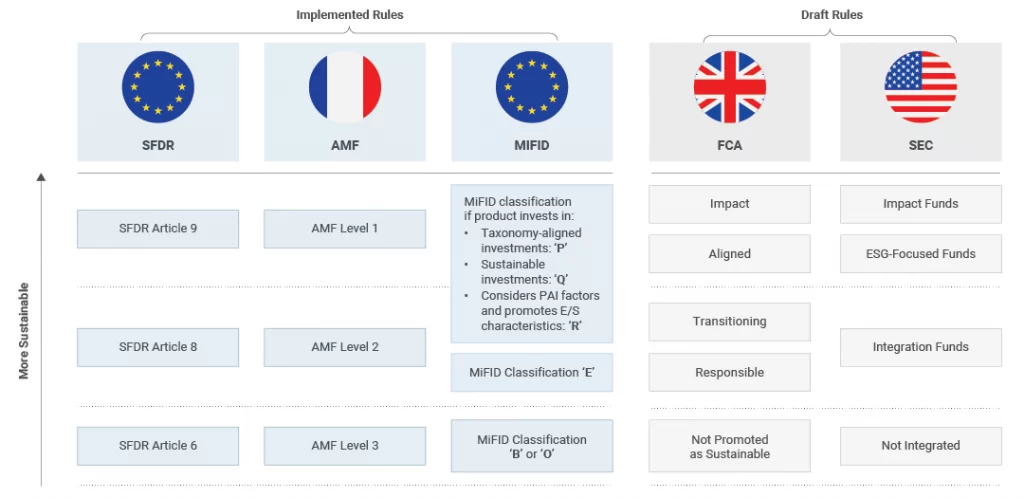

- European Union: In the EU, the focus is on the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation (SFDR). The CSRD, which came into force on January 5, 2023, extends the scope of sustainability reporting. It impacts around 50,000 entities, including businesses, banks, and insurance companies, significantly more than the previous Non-Financial Reporting Directive (NFRD). Additionally, the EU Taxonomy, effective since 2020, obliges large companies to disclose the extent to which their activities align with the EU Taxonomy’s six environmental objectives, encompassing aspects like climate change mitigation, adaptation, and impact on biodiversity.

These developments reflect a broader trend towards more rigorous and comprehensive ESG reporting and accountability in Europe. The aim is to improve the quality of information available to investors and other stakeholders, thereby fostering more sustainable economic activities and practices.

ESG in North America

The ESG regulatory landscape in North America, particularly in the United States, is characterized by a mix of evolving federal regulations and diverse state-level approaches.

Federal Level:

- SEC Proposals: The Securities and Exchange Commission (SEC) proposed rules in 2022 to enhance disclosures by investment advisers and companies about ESG investment practices. These rules categorize ESG investment funds into three types: Integration Funds, ESG-Focused Funds, and Impact Funds. The finalization of this rule is expected in 2024.

- Mandatory Disclosures and Climate-related Risks: The SEC’s proposed rules would require domestic and foreign issuers to disclose information on climate-related risks and greenhouse gas emissions in their financial statements. This includes board and management climate-related risk oversight, material climate-related risks over short, medium, and long terms, and the impact of climate events on financial statements. Larger issuers would also need third-party attestation for their Scope 1 and 2 disclosures, with some also requiring Scope 3 emissions reporting over time.

- California Climate Disclosure Bills: Two bills in California, SB 253 and SB 261, will mandate climate reporting by 2026, thus companies will need to start preparing in 2024. These bills are significant as they include large U.S. companies doing business in California and notably include private companies.

State-Level Initiatives and Challenges:

- Varied State Responses: States have taken different approaches towards ESG. For instance, Arizona announced the end of investigations into investment firms pursuing ESG investing. In contrast, Florida and Indiana have taken steps to limit or question ESG investing in public retirement systems and state investment policies.

- Anti-Boycott Bills: Several states, such as Kentucky, Oklahoma, Texas, and West Virginia, have enacted laws targeting companies that engage in boycotts of fossil fuel companies or discriminate against firearms entities. These laws require or authorize state regulators to maintain a blacklist of financial entities engaged in such boycotts. This approach has raised questions about the impact on companies’ ability to comply with these laws while maintaining their investment strategies.

The evolving landscape in North America reflects a broader global trend towards more sustainable and responsible business practices. This transition is driven by a combination of regulatory changes, investor demands, consumer preferences, and industry-specific trends.

ESG in Asia

The ESG regulatory landscape in the Asia-Pacific region is marked by a surge in regulation, reflecting a growing emphasis on sustainability and responsible investing. Here are some notable developments across key countries in the region as of 2024:

Singapore

- Singapore-Asia (Green and Transition) Taxonomy: This taxonomy, finalized in December 2023, is the world’s first multi-sector transition taxonomy and includes a framework for phasing out coal-fired power. Financial and non-financial companies started applying this taxonomy in 2024.

- Monetary Authority of Singapore’s Transition Planning: Recommendations for financial institutions on developing credible net-zero transition plans were expected to be finalized in 2024.

Australia

- Sustainable Finance Strategy: The Australian government published a draft sustainable finance strategy in November 2023, aimed at mobilizing private and public investment for transitioning to lower-carbon and more sustainable operations. Implementation of this strategy’s measures began in 2024.

- Sustainable Finance Taxonomy: Work on developing a sustainable finance taxonomy was ongoing, focusing on defining sustainable economic activities.

China

- ESG Disclosure Rules: The Ministry of Ecology and Environment in China planned to mandate ESG disclosure rules starting in 2022 for select listed companies and bond issuers, focusing on environment-related data.

- Cooperation with the EU: China has been working with the European Union to develop a “Common Ground Taxonomy” for sustainable business activities and green finance. This framework, while currently non-binding, could potentially become a significant driving force in ESG markets.

Japan

- Corporate Governance Code (CGC): The Japan Financial Service Agency’s latest revision to the CGC requires corporate boards to assume greater responsibility for managing ESG issues, improve diversity and independence, and develop and disclose initiatives promoting positive ESG outcomes.

- Climate-related Disclosures: Starting in 2023, all companies submitting annual securities reports in Japan are required to make climate-related disclosures.

India

- Bombay Stock Exchange (BSE) Guidance on ESG: BSE has published a guidance document on ESG regulations to companies and investors, providing specific issues and metrics for focus.

- Securities and Exchange Board of India (SEBI) Reporting Norms: SEBI has notified new disclosure norms on sustainability reporting for the top 1,000 listed companies by market capitalization by FY23.

Other Countries

- Hong Kong: The Hong Kong Stock Exchange has introduced ESG-focused listing requirements to enhance corporate governance transparency.

- Malaysia: Bank Negara Malaysia plans to implement a green taxonomy, and the Securities Commission of Malaysia released a Sustainable and Responsible Investment (SRI) Roadmap.

- Thailand: The Securities and Exchange Commission (SEC) of Thailand publishes an annual list of companies meeting their ESG performance criteria.

These developments indicate a rapidly evolving ESG regulatory landscape in the Asia-Pacific region, with an increasing focus on sustainability and transparency. Businesses operating in these markets need to adapt to these regulatory changes to ensure compliance and capitalize on the emerging opportunities in sustainable finance.

ESG in Latam

The ESG regulatory landscape in Latin America is evolving, influenced by both internal developments and external pressures, particularly from international markets and standards. Here are some key aspects of the current ESG environment in the region:

- External Influences and Compliance Requirements: Latin American companies are increasingly facing the need to align their production processes with global ESG agendas, especially to maintain access to international markets like the European Union. This alignment is driven by regulations adopted by regions such as the European Union, which have extraterritorial influence, affecting Latin American firms in areas like supply chain transparency and labor practices.

- Voluntary Adoption and Transition to Mandatory Disclosures: Currently, many businesses in Latin America adopt ESG principles voluntarily, recognizing potential financial and commercial opportunities. However, a shift towards mandatory ESG disclosure requirements is on the horizon, with several governments in the region planning to enforce such regulations. This move reflects a broader global trend towards sustainable business practices and corporate governance.

Notable Country-Specific Initiatives

- Colombia: In collaboration with the Global Reporting Initiative, the Colombian Stock Exchange launched a guide for preparing ESG reports, encouraging sustainability reports aligned with international standards.

- Chile: The Financial Market Commission issued General Rule No. 461, requiring targeted issuers to disclose sustainability and corporate governance performances in their annual reports.

- Brazil: The Brazilian Ministry of Finance and Securities and Exchange Commission is integrating the International Sustainability Standards Board’s International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards into the national regulatory framework, with voluntary adoption starting in 2024 and mandatory implementation by 2026.

ESG in MENA

Regulatory Changes Impacting Corporate Governance:

- In Saudi Arabia, regulations regarding annual director remuneration have been revised, removing the previous cap on remuneration.

- The UAE and Morocco are introducing provisions for increased women representation on public boards.

- Qatar has implemented a more defined framework for related party transactions (RPTs).

- The UAE now allows share issuances at a discount and Saudi Arabia permits the issuance of different classes of shares.

- Saudi Arabia has also introduced squeeze-out rights, allowing majority shareholders to compel minority shareholders to sell their shares under certain conditions.

Environmental and Sustainability Initiatives:

- The region has seen various initiatives, including Saudi Arabia’s ESG disclosure guidelines and Oman’s National Net Zero plan focusing on green hydrogen to create jobs.

- The UAE has announced a $100 billion clean energy partnership with the United States.

- The region hosted two COP conferences in Sharm El Sheikh and Dubai, emphasizing the growing importance of environmental issues in the Middle East.

Institutional and Industry Developments:

- The Oil & Gas and Construction industries are key areas of focus, with companies taking steps to address ESG concerns. Efforts include reducing carbon emissions and improving occupational safety and human rights practices.

- The financial services sector is crucial in promoting sustainable finance, digital financial inclusion, and reducing carbon footprints. Green investments are expected to significantly boost GDP growth in the Gulf Cooperation Council (GCC) region.

Conclusion

The ESG regulatory landscape is marked by rapid evolution and increasing complexity. Businesses worldwide must grapple with varied requirements and seize the opportunities presented by sustainable finance regulations. This environment requires vigilance, adaptability, and strategic foresight to navigate successfully.

References

- Clarity AI. (2024). Quick Take on the ESG Regulatory Landscape in 2024: Part 1 – Europe. [online] Available at: https://clarity.ai.

- Clarity AI. (2024). Quick Take on the ESG Regulatory Landscape in 2024: Part 2 – US and APAC. [online] Available at: https://clarity.ai.

- Board.org. (2024). State of ESG in 2024: Navigating a Complex Regulatory and Political Landscape. [online] Available at: https://board.org.

- Harvard Law School Forum on Corporate Governance. (2023). ESG Battlegrounds: How the States Are Shaping the Regulatory Landscape in the U.S. [online] Available at: https://corpgov.law.harvard.edu.

- Global Compliance News. (2021). United States: ESG investing faces changing regulatory landscape. [online] Available at: https://www.globalcompliancenews.com.

- Invesco. (n.d.). ESG Regulation in Asia. [online] Invesco. Available at: https://www.invesco.com/apac/en/country-splash.html?src=%2Fapac%2Fen%2Finstitutional%2Finsights%2Fesg%2Fesg-regulation-in-asia.html.

- Eco-Business. (n.d.). What to expect from Asia-Pacific’s burgeoning ESG market. [online] Eco-Business. Available at: https://www.eco-business.com/opinion/what-to-expect-from-asia-pacifics-burgeoning-esg-market/.

- Latham & Watkins. (2023). Regulatory Updates in Asia: ESG – August 2023. [online] Latham & Watkins. Available at: https://www.lw.com/en/insights/regulatory-updates-in-asia-esg-august-2023.

- Asia Fund Managers. (n.d.). Increasing ESG Regulations in Asia. [online] Asia Fund Managers. Available at: https://asiafundmanagers.com/int/increasing-esg-regulations-in-asia/.

- ISS Governance. (n.d.). Recent Regulatory Changes in Key MENA Markets Expected to Reshape Corporate Governance. [online] ISS Governance. Available at: https://insights.issgovernance.com/posts/recent-regulatory-changes-in-key-mena-markets-expected-to-reshape-corporate-governance/.

- PwC Middle East. (n.d.). PwC Middle East ESG Survey. [online] PwC. Available at: https://www.pwc.com/m1/en/esg/survey.html.

- Grand View Research. (n.d.). ESG Landscape in the Middle East Region: Regulation, Investments, Latest Initiatives by Industry Participants. [online] Grand View Research. Available at: https://astra.grandviewresearch.com/blog/esg-landscape-in-the-middle-east-region-regulation-investments-latest-initiatives-by-industry-participants.

- RSM Global. (n.d.). ESG in MENA: Realities, Challenges, and Opportunities. [online] RSM Global. Available at: https://www.rsm.global/insights/esg-mena-realities-challenges-and-opportunities.

- Norton Rose Fulbright. (n.d.). The Developing Legal and Regulatory Regime for ESG in the Middle East and Emerging DO Exposures. [online] Norton Rose Fulbright. Available at: https://www.nortonrosefulbright.com/en/knowledge/publications/730055eb/the-developing-legal-and-regulatory-regime-for-esg-in-the-middle-east-and-emerging-do-exposures.