ESG Practice

In the evolving landscape of global business, the concept of Environmental, Social, and Governance (ESG) has emerged as a transformative force, guiding companies towards sustainable and ethical practices. ESG criteria serve as a guide for investors, stakeholders, and consumers seeking to align their values with their financial decisions, investments, and purchases. This framework not only fosters a more sustainable and equitable world but also highlights the intrinsic link between ethical operations and long-term corporate success. As ESG continues to gain traction, understanding its components and implications becomes essential for navigating the future of business.

History

The Silent Spring

The journey of Environmental, Social, and Governance principles began in the vibrant 1960s with Rachel Carson’s groundbreaking book “The Silent Spring.” The book unveiled the hidden environmental hazards of rampant pesticide use, notably DDT, marking a pivotal moment in the quest for corporate environmental accountability and public health protection.

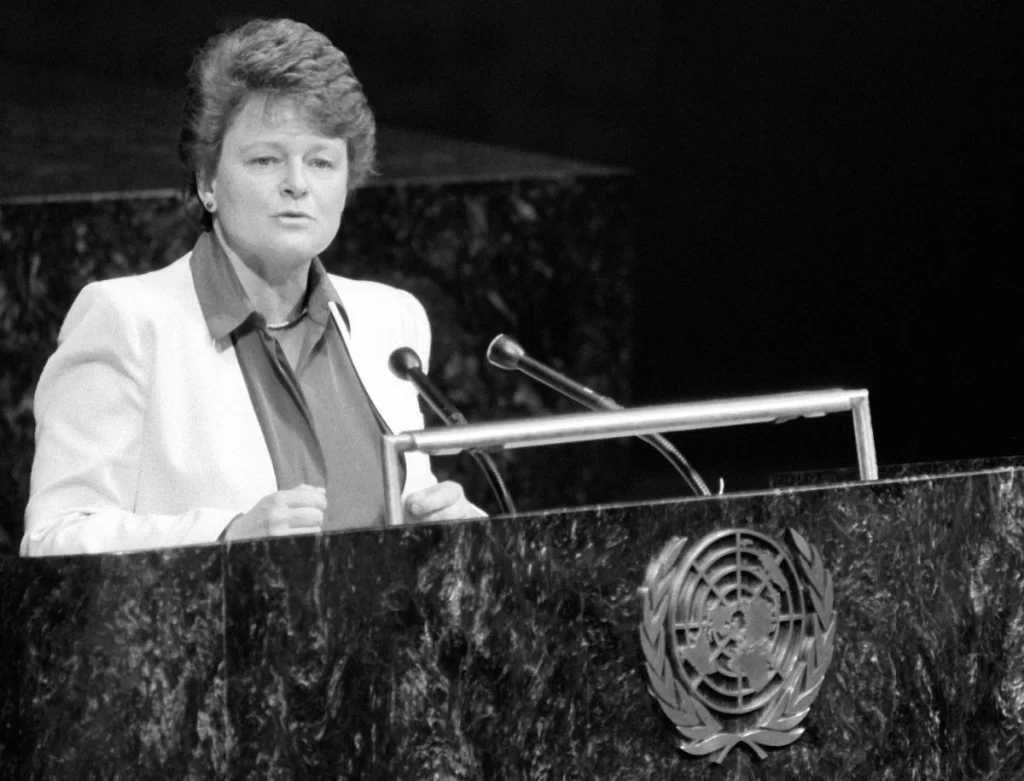

Brundtland Commission

Fast forward to 1987, when the United Nations’ Brundtland Commission, a body focused on environmental and developmental harmony, stepped onto the world stage. Their revolutionary concept? “Sustainable development” – a daring idea advocating for meeting today’s needs without jeopardizing future generations’ prospects. This concept was a game-changer in aligning economic growth with environmental preservation.

United Nations Environment Program (UNEP)

The plot thickens in 1992 with the United Nations Environment Progra issuing a bold Statement of Commitment by Financial Institutions on Sustainable Development. This document, a cornerstone of the UNEP Finance Initiative born from the Rio Earth Summit, saw financial giants pledge to embed environmental and social considerations into their core operations, reshaping the economic landscape towards sustainability.

In 1994, John Elkington unveiled the Triple Bottom Line (TBL), a revolutionary framework marrying a company’s social, environmental, and economic impacts. Elkington’s vision was to transform traditional financial accounting, urging businesses to measure success not just in dollars but in their broader impact on society and the planet. TBL was more than a theory; it was a call to action for businesses to harmonize their economic goals with societal and environmental responsibilities.

The new millennium ushered in another milestone with the European Commission’s 2001 paper on Corporate Social Responsibility (CSR). This strategy was a clarion call for enterprises to acknowledge and act on their societal impacts, setting the stage for a new era of corporate accountability without a one-size-fits-all measurement approach.

2004 marked a defining moment with the “Who Cares Wins” report, a result of a United Nations-led collaboration involving major financial institutions. This groundbreaking report, crafted by institutions from nine countries managing over $6 trillion, supported by CEOs and funded by the Swiss Government, was a clarion call for integrating ESG factors in asset management and related fields. It redefined the investment landscape, suggesting that companies adept in managing ESG issues could enhance shareholder value through risk management, regulatory foresight, market access, and brand reputation enhancement.

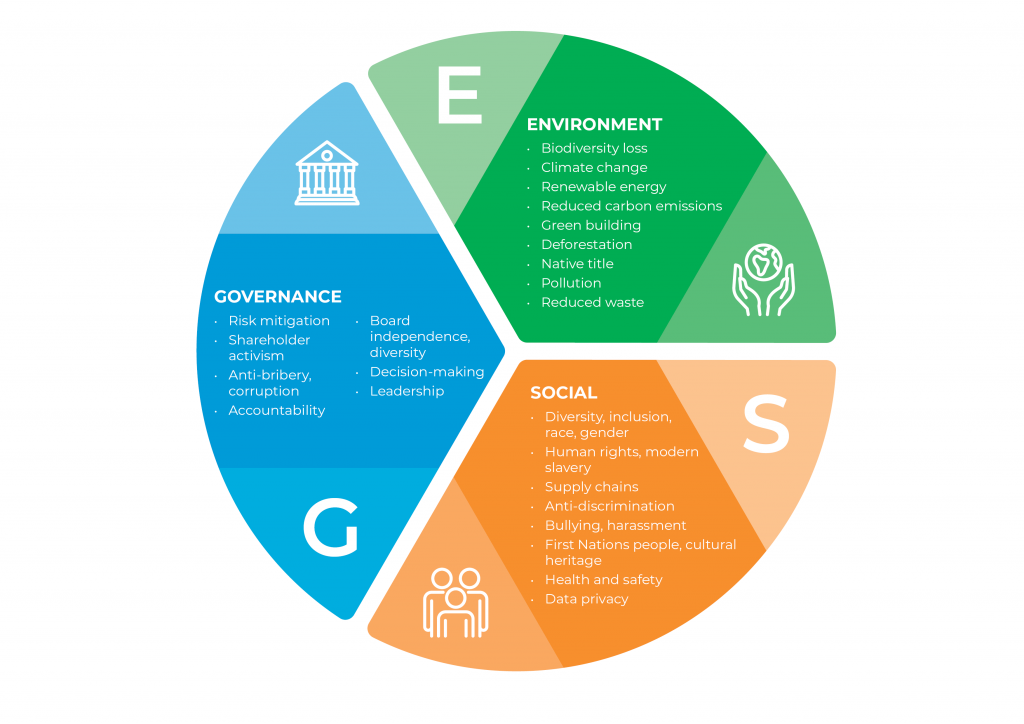

Environmental Criteria

The environmental component of ESG focuses on a company’s ecological footprint, evaluating practices related to energy use, waste management, pollution control, and resource conservation. In the face of escalating climate change concerns, businesses are increasingly called upon to adopt sustainable practices, such as reducing carbon emissions, enhancing energy efficiency, and embracing renewable energy sources. These measures not only contribute to the global sustainability agenda but also offer potential for innovation and cost savings, aligning environmental stewardship with business resilience and growth.

Social Criteria

The social dimension of ESG examines how a company manages relationships with employees, suppliers, customers, and the communities in which it operates. Key considerations include labor practices, diversity and inclusion, human rights, and community engagement. Companies that excel in these areas often enjoy enhanced reputation, customer loyalty, and employee satisfaction, translating into tangible business benefits. The emphasis on social criteria reflects a growing recognition of the value of ethical and equitable business practices in building sustainable and resilient organizations.

Governance Criteria

Governance in ESG pertains to the quality of a company’s management, board structure, policies, and internal controls. It encompasses issues such as executive compensation, shareholder rights, and anti-corruption measures. Effective governance is foundational to ensuring a company’s accountability and transparency, fostering trust among investors and stakeholders. In today’s complex business environment, robust governance practices are indispensable for navigating ethical dilemmas, mitigating risks, and securing long-term success.

Challenges and Criticisms of ESG

Despite its widespread adoption, ESG faces significant challenges and criticisms. One of the most prominent issues is greenwashing, where companies make misleading claims about their environmental or social initiatives, obscuring their actual impacts. This practice undermines trust in ESG reporting and hampers meaningful progress. Additionally, the lack of standardized ESG metrics complicates the assessment and comparison of companies’ ESG performance, leading to confusion and skepticism among investors. Critics also argue that the focus on ESG can divert attention from core business objectives, potentially impacting financial performance. Furthermore, the evolving regulatory landscape and varying global standards pose challenges for companies striving to align their practices with ESG criteria, highlighting the need for greater clarity and consistency in ESG frameworks.

About GreenUP

Pioneering the Green Transition with Expertise and Innovation. With over 10 million I-RECs issued since 2019, we are Vietnam’s leaders in renewable energy certification. Our comprehensive suite of services, positions us uniquely as a one-stop solution for all your green and ESG needs. Experience unparalleled market access, competitive pricing, and strategic partnerships that drive not only cost savings but also significant value to your sustainability goals.

Conclusion

By intertwining environmental stewardship, social responsibility, and ethical governance, ESG offers a roadmap for companies to navigate the complexities of the 21st century. Despite facing challenges such as greenwashing and the need for standardization, the momentum behind ESG is undeniable, driven by a collective aspiration for a sustainable and equitable global economy. As we move forward, the continued evolution and integration of ESG principles will be instrumental in fostering resilient businesses and societies.

References

- International Institute for Sustainable Development (IISD). (n.d.). The Message from the Brundtland Commission Continues to Resonate: Thirty Years On. Available at: https://www.iisd.org/articles/insight/message-brundtland-commission-continues-resonate-thirty-years.

- Atkins, B. (2020). Demystifying ESG—Its History & Current Status. Forbes. Available at: https://www.forbes.com/sites/betsyatkins/2020/06/08/demystifying-esgits-history–current-status/?sh=4f250c582cdd.

- The Corporate Governance Institute. (n.d.). What is the History of ESG? Available at: https://www.thecorporategovernanceinstitute.com/insights/lexicon/what-is-the-history-of-esg/.

- ESGgo. (n.d.). A Brief History of ESG. Available at: https://www.esggo.com/blog/a-brief-history-of-esg.

- Vu, T.H., & Nguyen, H.T. (2019). Environmental, Social and Governance (ESG) Disclosure and Corporate Financial Performance: A Case Study of Vietnam. Journal of Science and Technology Policy Management, 10(5). Available at: https://js.vnu.edu.vn/PaM/article/view/4385/4041.

- Holding Redlich. (n.d.). Environmental, Social and Governance (ESG) Explained: Five Important Considerations for Companies and Their Lawyers. Available at: https://www.holdingredlich.com/environmental-social-and-governance-esg-explained-five-important-considerations-for-companies-and-their-lawyers

- Chen, J. (2021). Environmental, Social, and Governance (ESG) Criteria. Investopedia. Available at: https://www.investopedia.com/terms/e/environmental-social-and-governance-esg-criteria.asp

- MSCI. (n.d.). ESG Investing. Available at: https://www.msci.com/documents/1296102/7943776/ESG+Investing+brochure.pdf/bcac11cb-872b-fe75-34b3-2eaca4526237 (Accessed: 28 December 2023).

- TechTarget. (n.d.). Environmental, Social and Governance (ESG). Available at: https://www.techtarget.com/whatis/definition/environmental-social-and-governance-ESG

- Corporate Finance Institute. (n.d.). ESG (Environmental, Social, Governance). Available at: https://corporatefinanceinstitute.com/resources/esg/esg-environmental-social-governance/

- Gartner. (n.d.). Environmental, Social and Governance (ESG) – Glossary. Available at: https://www.gartner.com/en/finance/glossary/environmental-social-and-governance-esg-

- MSCI. (n.d.). ESG 101: What is ESG? Available at: https://www.msci.com/esg-101-what-is-esg