Introduction

Vietnam is making significant strides in the global fight against climate change through its expanding portfolio of carbon credit projects. As the world pivots towards renewable energy solutions, Vietnam’s commitment is reflected in the notable increase in both registered and certified carbon credit initiatives across the country.

A Growing Presence in the Carbon Market

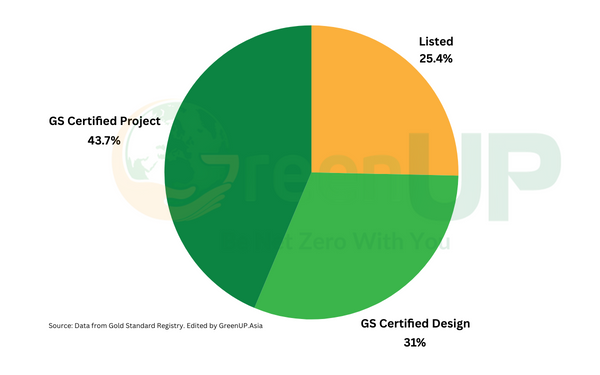

Recent data reveals a dynamic scene for carbon credits in Vietnam. According to Gold Standard, as of May 2024, Vietnam boasts 71 renewable energy projects, with 31 of these (43.7%) achieving certification for carbon credits. These projects, primarily in wind and small hydro sectors, are either in the “Listed” or “Gold Standard Design Certified” stages.

From 2007 to 2020, the Clean Development Mechanism (CDM) registered 274 projects in Vietnam for carbon credits, with 87 of these projects getting certified, accumulating over 32 million credits—a testament to the country’s early and ongoing commitment to carbon reduction initiatives.

Moreover, Verra’s records show that out of 44 projects registered in Vietnam, 37 have been certified for carbon credits. This high certification rate shows the country’s effective implementation and monitoring of carbon credit projects. Meanwhile, the Joint Credit Mechanism (JCM) notes 14 registered projects with two projects issuing a commendable total of 4415 credits as of May 2024.

Navigating New Regulatory Waters

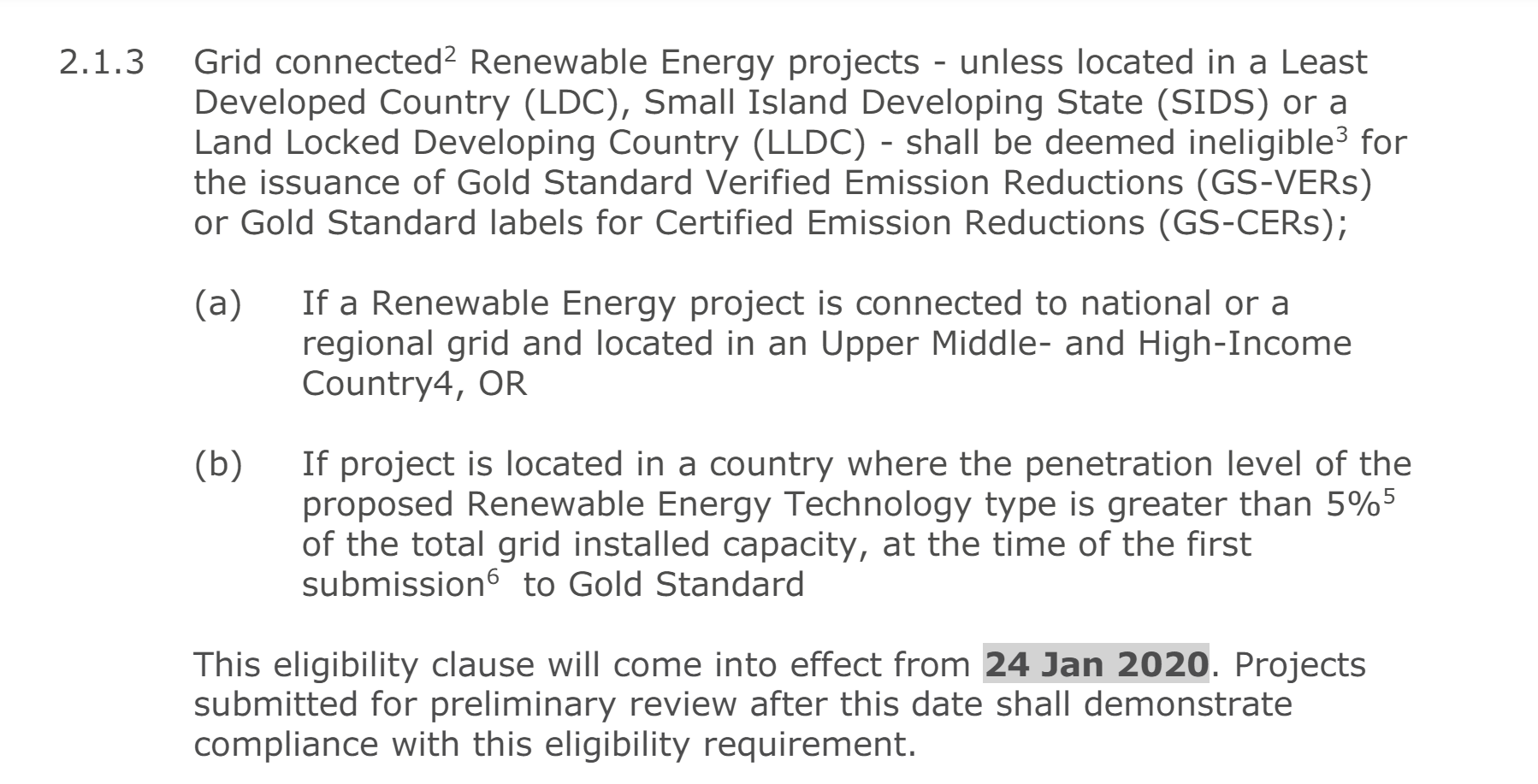

The path to expanding Vietnam’s renewable energy landscape has encountered a new requirement for renewable energy projects, introduced by Gold Standard, which came into effect on January 24, 2020. These regulations introduced stricter eligibility requirements for renewable energy projects seeking to register for carbon credits, particularly affecting grid-connected initiatives.

Under the new requirement, projects in countries that are not classified as Least Developed Countries (LDCs), Small Island Developing States (SIDS), or Land Locked Developing Countries (LLDCs) face greater scrutiny. Specifically, projects in upper-middle- and high-income countries, or those in locations where the renewable technology type exceeds 5% of the total grid capacity, may find themselves ineligible for Gold Standard Verified Emission Reductions (GS-VERs) or Gold Standard labels for Certified Emission Reductions (GS-CERs).

This eligibility criterion is designed to prioritize the deployment of renewable technologies in regions where they are not yet prevalent, ensuring that the benefits of carbon credits directly contribute to sustainable development and emissions reduction in areas most in need.

Key Challenges for Project Developers

Regulatory Complexity and Frequent Changes: Project developers often grapple with the complexities of adhering to international and local certification standards, especially given the stringent and frequently changing eligibility criteria set by bodies like the Gold Standard. These regulatory adjustments can lead to project delays, increased costs, and even deter the initiation of promising projects.

Financial and Investment Uncertainty: Accessing capital is a major hurdle. The early stages of project development are particularly risky, and the volatile nature of the carbon credit market adds to the financial uncertainty. This environment can make it difficult to attract investment, as potential financiers often seek more stable and predictable returns. Additionally, the lack of established financial frameworks and incentives for carbon credit projects in Vietnam further complicates funding opportunities.

Technological and Market Barriers: While Vietnam has embraced renewable energy, the technological landscape for advanced renewable projects remains underdeveloped compared to more established markets. The shortage of local expertise and high-tech infrastructure can impede the deployment and scalability of innovative technologies. Furthermore, the nascent state of the carbon market in Vietnam leads to limited access to market information and trading platforms, which are crucial for the valuation and exchange of carbon credits.

Environmental and Social Impact Concerns: Developing projects that are both environmentally sustainable and socially inclusive remains a challenge. Project initiators must conduct thorough environmental impact assessments to mitigate negative impacts on biodiversity and ecosystems. Social impact assessments are also critical to ensure that local communities benefit from projects and are not adversely affected. Failure to adequately address these aspects can lead to community opposition, legal challenges, and reputational damage.

Infrastructure and Grid Integration: For renewable energy projects, particularly those that are grid-connected, integration into Vietnam’s existing power infrastructure poses a significant challenge. The national grid may lack the capacity to incorporate intermittent power sources like wind or solar, especially in remote or underdeveloped areas. This can require additional investment in grid upgrades or the development of local storage solutions, which adds to the project costs. We highlight this challenge in a different article. For more details, please view here.

Policy and Governmental Support: Although there is strong governmental interest in renewable energy, the actual policy support and implementation can be inconsistent. There are needs for clearer policies, better incentives for renewable projects, and more robust support mechanisms to encourage both local and international developers. Without strong policy support, projects may face higher risks and lower feasibility.

Market Accessibility and Transparency: The carbon credit market in Vietnam lacks the maturity seen in more established markets, which can lead to transparency issues in the trading and valuation of carbon credits. Developers might find it challenging to navigate market dynamics, leading to potential undervaluation of credits or difficulties in finding buyers. Establishing a transparent, accessible market is essential for the growth of the carbon credit system in Vietnam.

A Path Forward

Navigating these challenges requires a multifaceted approach involving enhanced governmental support, international cooperation, and the development of local expertise and technological capabilities. Strengthening financial mechanisms and market structures will also be crucial for advancing Vietnam’s carbon credit initiatives. Despite the hurdles, Vietnam’s commitment to expanding its portfolio of carbon credit projects is a promising step towards achieving its sustainable development and climate goals. As these initiatives continue to evolve, they offer valuable lessons and opportunities for scaling up renewable energy projects and carbon credit markets both domestically and globally.

About GreenUP

Pioneering the Green Transition with Expertise and Innovation. With over 10 million I-RECs issued since 2019, we are Vietnam’s leaders in renewable energy certification. Our comprehensive suite of services, positions us uniquely as a one-stop solution for all your green and ESG needs. Experience unparalleled market access, competitive pricing, and strategic partnerships that drive not only cost savings but also significant value to your sustainability goals.

References

- Gold Standard, 2024. Projects. [online] Available at: https://registry.goldstandard.org/projects?q=&page=1.

- Gold Standard, 2024. Renewable Energy Activity Requirements. [online] Available at: https://globalgoals.goldstandard.org/standards/202_V1.2_AR_Renewable-Energy-Activity-Requirements.pdf.

- Ministry of Natural Resources and Environment of Vietnam, 2024. Challenges for Vietnam to reduce CO2 emissions. [online] Available at: https://monre.gov.vn/English/Pages/Challenges-for-Vietnam-to-reduce-CO2-emissions.aspx.

- United Nations Framework Convention on Climate Change, 2024. CDM Registry. [online] Available at: https://cdm.unfccc.int/Registry/index.html.

- Verra, 2024. Registry. [online] Available at: https://registry.verra.org/.

- Vietnam News, 2024. Vietnam has great potential in development of carbon credit market. [online] Available at: https://vietnamnews.vn/economy/business-beat/1639211/viet-nam-has-great-potential-in-development-of-carbon-credit-market.html.

- Vietnam.vn, 2024. Challenges in the development of the carbon market in Vietnam. [online] Available at: https://www.vietnam.vn/en/thach-thuc-trong-phat-trien-thi-truong-cac-bon-tai-viet-nam/.

- VietnamNet, 2024. Vietnam has great potential in development of carbon credit market. [online] Available at: https://vietnamnet.vn/en/vietnam-has-great-potential-in-development-of-carbon-credit-market-2239783.html.

- VietnamPlus, 2024. Carbon market development key to green transition. [online] Available at: https://en.vietnamplus.vn/carbon-market-development-key-to-green-transition/271944.vnp.