Introduction to ESG Materiality Assessment

An ESG Materiality Assessment is a systematic process undertaken by organizations to identify, refine, and assess the various ESG issues that could potentially impact their business operations and stakeholders. This process involves organizing these issues into a prioritized list that can guide company strategy, objectives, and reporting. The goal is to focus on the most significant ESG topics that are pertinent to the business and its stakeholders, ensuring that the organization’s resources are allocated effectively toward addressing the most material issues.

ESG considerations have become integral to contemporary business and investment decisions due to the increasing awareness and concern about sustainability issues among consumers, investors, and regulators. Materiality in ESG refers to the significance of an ESG issue in the context of a company’s business performance and stakeholder value. Understanding and prioritizing material ESG issues is a crucial component in developing a sustainable and successful ESG strategy. This is especially relevant given the vast array of potential ESG topics and the need for organizations to concentrate their efforts on areas that are most impactful to their operations.

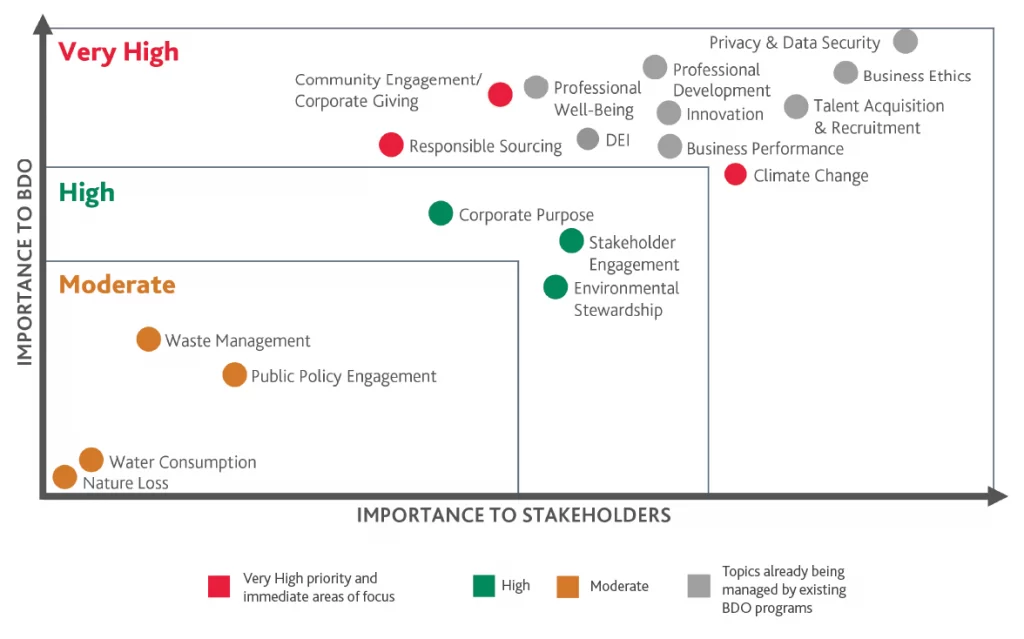

Materiality assessments guide companies by providing a structured approach to identifying and prioritizing ESG issues. This involves a multi-stakeholder process where both internal (e.g., employees, management) and external (e.g., customers, investors, communities) stakeholders assess the relative importance of various ESG topics. This is typically visualized through a Materiality Matrix, which plots the significance of each issue against its impact on the company and its stakeholders. The assessment helps companies focus their ESG efforts on areas that are most likely to affect their business success and stakeholder relationships over the medium to long term. By doing so, organizations can better manage risks, seize opportunities, and align their strategies with stakeholder expectations, thereby enhancing their overall sustainability performance and competitive advantage.

The Concept of Materiality in ESG

In the context of ESG, materiality refers to the relevance and importance of certain issues to a company’s ESG reporting. It’s about identifying which ESG topics are significant enough to be included in a company’s sustainability report, based on their impact on the business and stakeholders. Materiality in ESG is determined through a risk-based approach, assessing the company’s vulnerabilities and the potential consequences of those risks. This helps in prioritizing ESG issues that could have a real and measurable impact on the business.

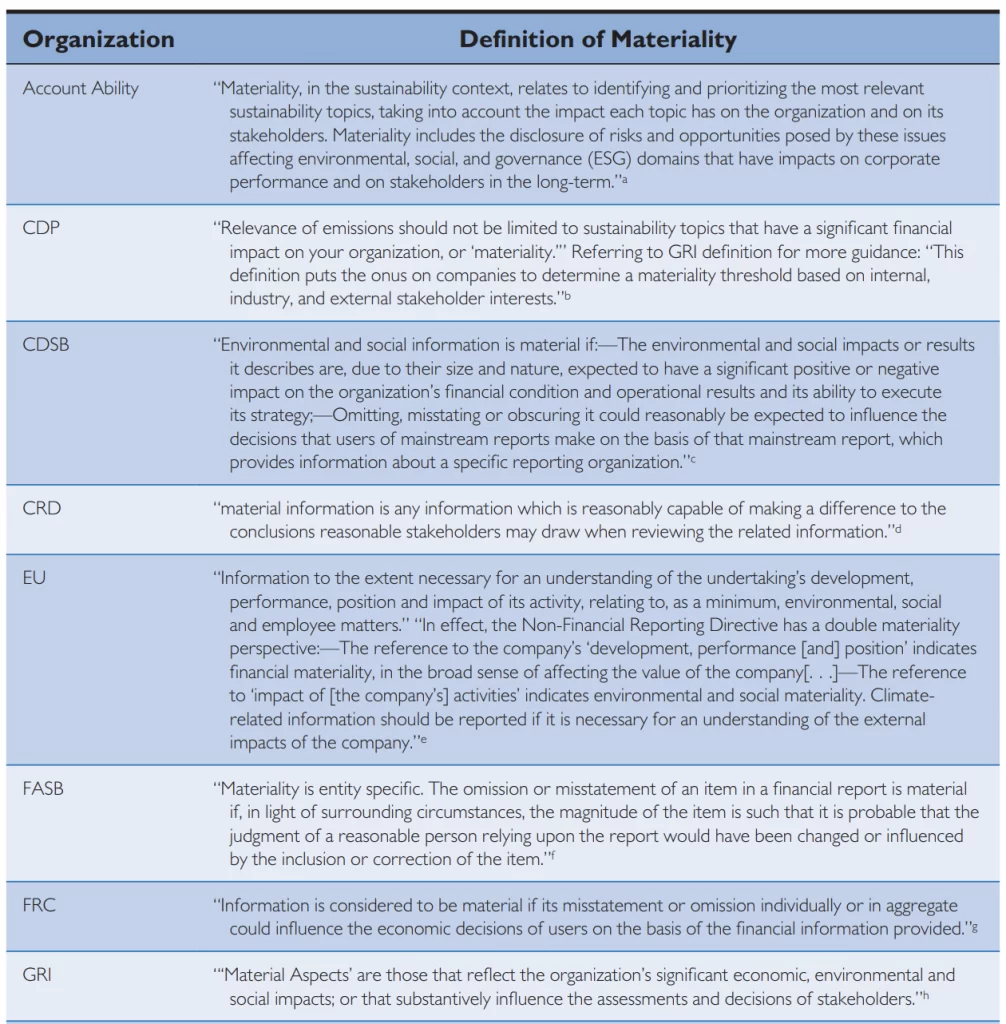

The concept of materiality has expanded over time, especially with the growing importance of sustainability topics in driving long-term financial performance. Historically, materiality in business was primarily concerned with financial information that would influence an investor’s decision-making. However, as sustainability and ESG topics gained prominence, the definition of materiality broadened to encompass issues that could significantly impact a company’s financial condition, operating performance, or risk profile. This shift reflects a broader view of value creation, risks, opportunities, and dependencies, incorporating sustainability themes into mainstream corporate performance and reporting practices.

Differences between financial materiality and ESG materiality:

- Financial materiality: Concerned with information influencing investor decisions, focused on financial performance.

- ESG materiality: Extends beyond financial impacts to consider broader social and environmental effects.

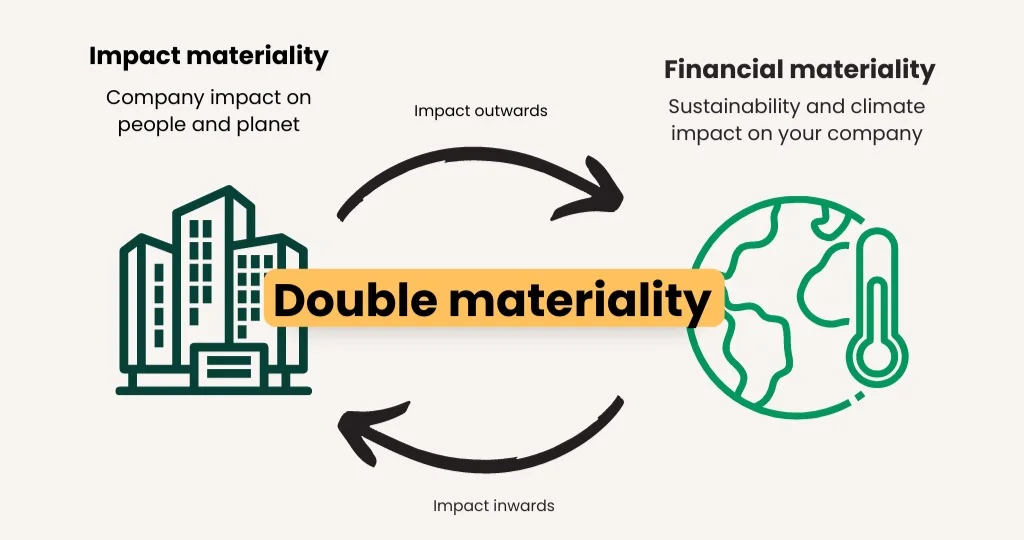

EU’s Corporate Sustainability Reporting Directive (CSRD) introduces “double materiality,” covering both the financial impact of sustainability topics on the company and the company’s impact on society and the environment.

The ESG Materiality Assessment Process

To conduct an ESG Materiality Assessment, you can follow these steps, integrating insights from various sources for a comprehensive approach:

- Define Your Scope: Start by setting the boundaries, purpose, and timeframe of your assessment. Decide whether to focus on the entire organization or specific aspects like products, services, or regions.

- Stakeholder Engagement: Identify and engage with stakeholders such as customers, employees, investors, suppliers, and community members. Use surveys, interviews, and focus groups to gather their perspectives on ESG issues that matter to them.

- Gather Data: Collect relevant ESG performance data from financial reports, sustainability reports, regulatory filings, and industry benchmarks.

- Identify ESG Issues: Based on the data and stakeholder feedback, list potential ESG issues ranging from environmental impacts to social practices and governance standards.

- Assess Impact and Relevance: Evaluate the potential impact of each ESG issue on your organization and its relevance to stakeholders. Consider the financial, operational, reputational, and regulatory implications.

- Prioritize Material Issues: Prioritize the issues based on their significance to both the organization and stakeholders. A materiality matrix can be a useful tool for visualization.

- Report and Communicate: Create a materiality report or update your sustainability report to communicate the findings, including how the organization plans to address the material ESG issues.

- Integrate into Strategy: Incorporate the material issues into your strategic planning and allocate resources for effective management. Set clear targets and KPIs to monitor progress.

- Monitor and Review: Regularly review the organization’s progress on addressing material ESG issues and adjust the strategy as needed to align with stakeholder expectations and industry trends.

- Continuous Improvement: Conduct materiality assessments regularly to stay updated with changing ESG priorities and emerging issues.

Tools and frameworks like the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD) can provide structured guidelines and standards to help identify and report on material ESG issues relevant to different industries and operations. Learn more about the frameworks at ESG Reporting.

Integration of ESG Materiality Assessment in Strategy

Materiality assessments enable companies to identify sustainability issues critical to their business and stakeholders, providing a clear focus for strategic planning. By understanding which ESG topics are most relevant, companies can define suitable goals, KPIs, and set a framework for internal and external communication, ensuring impactful sustainability management.

Using the insights from materiality assessments, companies can prioritize strategic topics across the business, not just limiting their application to reporting. This prioritization helps in addressing the most significant ESG issues, thereby future-proofing the company’s strategy against emerging sustainability challenges.

Enhancing materiality assessments involves refining the process to ensure that it not only meets regulatory requirements but also provides strategic insights that can guide long-term business value creation. Below are key areas for materiality enhancement:

- Tailored Approach: Avoid a one-size-fits-all methodology. Recognize that materiality is context-specific, varying by industry, geography, and even within sectors. Customizing the assessment process to the specific context of the company ensures the identification of truly material issues.

- Strategic Alignment: Materiality assessments should be closely linked to the company’s core business strategy and objectives. This integration ensures that sustainability efforts are aligned with the company’s long-term goals, enhancing overall business performance and sustainability.

- Consideration of Long-term Risks and Opportunities: It’s essential to incorporate external long-term risks and opportunities into the assessment. This includes considering the impacts of emerging trends like disruptive technologies and climate change, which can significantly affect the company and its stakeholders over time.

- Inclusion of Emerging Topics: Materiality assessments should not only focus on current issues but also anticipate future sustainability trends and challenges. This proactive approach helps companies to stay ahead of emerging risks and opportunities.

- Broad Stakeholder Engagement: Engaging a wide range of stakeholders, both internal and external, provides a comprehensive view of material issues. This diverse input ensures a holistic understanding of the sustainability landscape and enhances the relevance and accuracy of the assessment.

- Leveraging Technology: Utilizing advanced technologies such as artificial intelligence and big data analytics can enhance the efficiency and comprehensiveness of materiality assessments. These technologies enable more accurate data analysis and can uncover insights that might be missed through traditional methods.

- Balanced Use of Data: While quantitative data provides measurable insights, qualitative data offers depth and context. A balanced approach that incorporates both types of data ensures a more nuanced understanding of material issues.

- Transparency and Accountability: Being open about the methodology, criteria, and sources used in the materiality assessment fosters trust among stakeholders. Transparency in the process and outcomes encourages stakeholder engagement and confidence in the company’s sustainability initiatives.

- Action-oriented Outcomes: The ultimate goal of a materiality assessment is to inform actionable strategies. Companies should ensure that the insights gained are integrated into tangible sustainability strategies, goals, and actions that drive long-term value creation.

- Continuous Improvement: Materiality assessments should not be viewed as a one-time exercise. Regular updates and reassessments are crucial to capture evolving sustainability trends and stakeholder expectations, ensuring that the company’s sustainability strategy remains relevant and effective.

Challenges and Best Practices in ESG Materiality Assessment

Conducting an ESG Materiality Assessment presents several challenges, but understanding and navigating these can lead to effective and impactful sustainability strategies. Common challenges include:

- Complexity and Scope: The breadth of ESG topics can be overwhelming, making it challenging to determine which issues are truly material to the business. The complexity increases when considering the interconnectivity of ESG factors and their varying impacts across different regions and stakeholder groups.

- Data Availability and Quality: Accessing reliable and comprehensive data to inform the materiality assessment can be a significant hurdle. Inconsistencies in data quality, availability, and granularity can lead to difficulties in accurately assessing the materiality of ESG issues.

- Stakeholder Engagement: Effectively engaging a diverse range of stakeholders, each with their unique perspectives and priorities, presents logistical and methodological challenges. Balancing these varied viewpoints to arrive at a consensus on material issues requires careful planning and facilitation.

- Dynamic ESG Landscape: The ESG landscape is rapidly evolving, with emerging issues and changing stakeholder expectations. Keeping the materiality assessment up-to-date and relevant in this shifting context demands continuous monitoring and adaptability.

- Integrating ESG into Core Strategy: Translating the findings of a materiality assessment into actionable business strategies is a complex process. Ensuring that ESG considerations are embedded into the core business strategy, rather than treated as peripheral issues, requires a shift in organizational mindset and culture.

- Regulatory and Reporting Compliance: Navigating the complex and often fragmented regulatory landscape related to ESG reporting and disclosures adds another layer of complexity. Ensuring compliance while also striving for transparency and accountability can be challenging.

- Resource Constraints: Conducting a thorough materiality assessment requires significant resources, including time, expertise, and financial investment. Resource constraints can limit the depth and frequency of assessments, impacting their effectiveness.

To address these challenges, companies can adopt the following best practices:

- Leverage Technology: Utilizing advanced data analytics and AI can improve the efficiency and accuracy of data collection and analysis, helping to overcome challenges related to data availability and quality.

- Engage Stakeholders Early and Often: Establishing ongoing dialogue with stakeholders can help in continuously capturing their changing priorities and expectations, making the materiality assessment more responsive to stakeholder needs.

- Adopt a Flexible Framework: Using a flexible and adaptable framework for the materiality assessment allows companies to respond to emerging ESG issues and regulatory changes more effectively.

- Integrate ESG into Decision-Making: Ensuring that ESG considerations are integrated into strategic planning and decision-making processes can help in aligning the materiality assessment outcomes with business objectives.

- Continuous Monitoring and Review: Regularly revisiting and updating the materiality assessment can help companies stay aligned with the dynamic ESG landscape and evolving stakeholder expectations.

- Expertise and Training: Investing in ESG expertise and training for the team conducting the materiality assessment can enhance the quality and impact of the process.

Conclusion

ESG Materiality Assessments is a tool for organizations to navigate the complex landscape of sustainability challenges. By identifying and prioritizing the ESG issues most relevant to their operations and stakeholders, companies can allocate resources more effectively, manage risks proactively, and seize opportunities for sustainable growth.

The dynamic nature of the ESG landscape, with its stakeholder expectations and regulatory requirements, highlights the importance of a robust, adaptable, and stakeholder-informed approach to materiality assessment. Companies that embed these insights into their strategic planning not only enhance their resilience and competitiveness but also contribute to a more sustainable and equitable global economy.

Continuous improvement and engagement, leveraging advanced technologies, and ensuring transparency and accountability are essential for maximizing the impact of these assessments. Ultimately, the goal is to transform ESG materiality from a reporting exercise into a strategic imperative that drives long-term value creation for businesses and society alike.

References

- Brightest. (n.d.). Materiality Assessment. Retrieved from https://www.brightest.io/materiality-assessment

- GetGoodLab. (n.d.). Materiality Assessment ESG. Retrieved from https://getgoodlab.com/resources/materiality-assessment-esg/

- Intelex Technologies. (2023, July 24). Understanding ESG Materiality: From Definition to Implementation. Retrieved from https://blog.intelex.com/2023/07/24/understanding-esg-materiality-from-definition-to-implementation/

- Perillon. (n.d.). What is ESG Materiality?. Retrieved from https://www.perillon.com/blog/what-is-esg-materiality

- ESG | The Report. (n.d.). What is Materiality in ESG?. Retrieved from https://www.esgthereport.com/what-is-materiality-in-esg/

- EY. (n.d.). ESG regulation gives materiality a bigger stake. Retrieved from https://www.ey.com/en_us/assurance/esg-regulation-gives-materiality-a-bigger-stake

- Polar Insight. (n.d.). Conducting an ESG Materiality Assessment: A Step-by-Step Guide. Retrieved from https://www.polarinsight.com/articles/conducting-an-esg-materiality-assessment

- Antea Group. (n.d.). 7 Basic Steps for Conducting a Successful Materiality Assessment. Retrieved from https://us.anteagroup.com/news-events/blog/7-basic-steps-conducting-successful-materiality-assessment

- Sage Journals. (2022). Unlocking Materiality: How the concept of materiality is operationalized in practice. Retrieved from https://journals.sagepub.com/doi/full/10.1177/00081256221120692

- Deloitte. (n.d.). Unlock the full strategic potential of materiality assessments. Retrieved from https://www2.deloitte.com/uk/en/insights/environmental-social-governance/unlock-the-full-strategic-potential-of-materiality-assessments.html

- BDO. (n.d.). Materiality Assessment: Identify the ESG Issues Most Critical to Your Company. Retrieved from https://www.bdo.com/insights/sustainability-and-esg/materiality-assessment-identify-the-esg-issues-most-critical-to-your-company

- Reuters. (2022, June 3). It’s time to really talk about ESG materiality. Retrieved from https://www.reuters.com/legal/legalindustry/its-time-really-talk-about-esg-materiality-2022-06-03/

- TechTarget. (n.d.). ESG materiality assessments: What CIOs and others need to know. Retrieved from https://www.techtarget.com/sustainability/feature/ESG-materiality-assessments-What-CIOs-others-need-to-know